Private Equity List

Discover and connect with top PE/VC investors effortlessly using our AI-powered database for seamless funding opportu...

Visit

About Private Equity List

PrivateEquityList.com is an elite database designed to connect startups, consultants, VCs, universities, and business owners with private equity firms and venture capital funds. With an intuitive search interface and a plethora of filters, the platform provides users with quick access to crucial investor data, enhancing fundraising efforts and strategic partnerships. The recent addition of an AI-powered search function elevates the user experience, enabling more precise data retrieval, while maintaining a user-friendly approach. This platform is particularly beneficial for businesses at any stage looking for funding, as it houses a vast array of information on over 10,300 users, all of whom trust its data for critical decision-making. Private Equity List stands out as the best value alternative to high-cost solutions like Pitchbook and Crunchbase, delivering robust, human-curated data at an affordable price.

Features of Private Equity List

AI-Powered Search Function

The newly introduced AI search functionality allows users to navigate the extensive database with unparalleled efficiency. By leveraging advanced algorithms, this feature delivers highly relevant results tailored to specific investment needs, albeit with a caveat that users should verify information for accuracy.

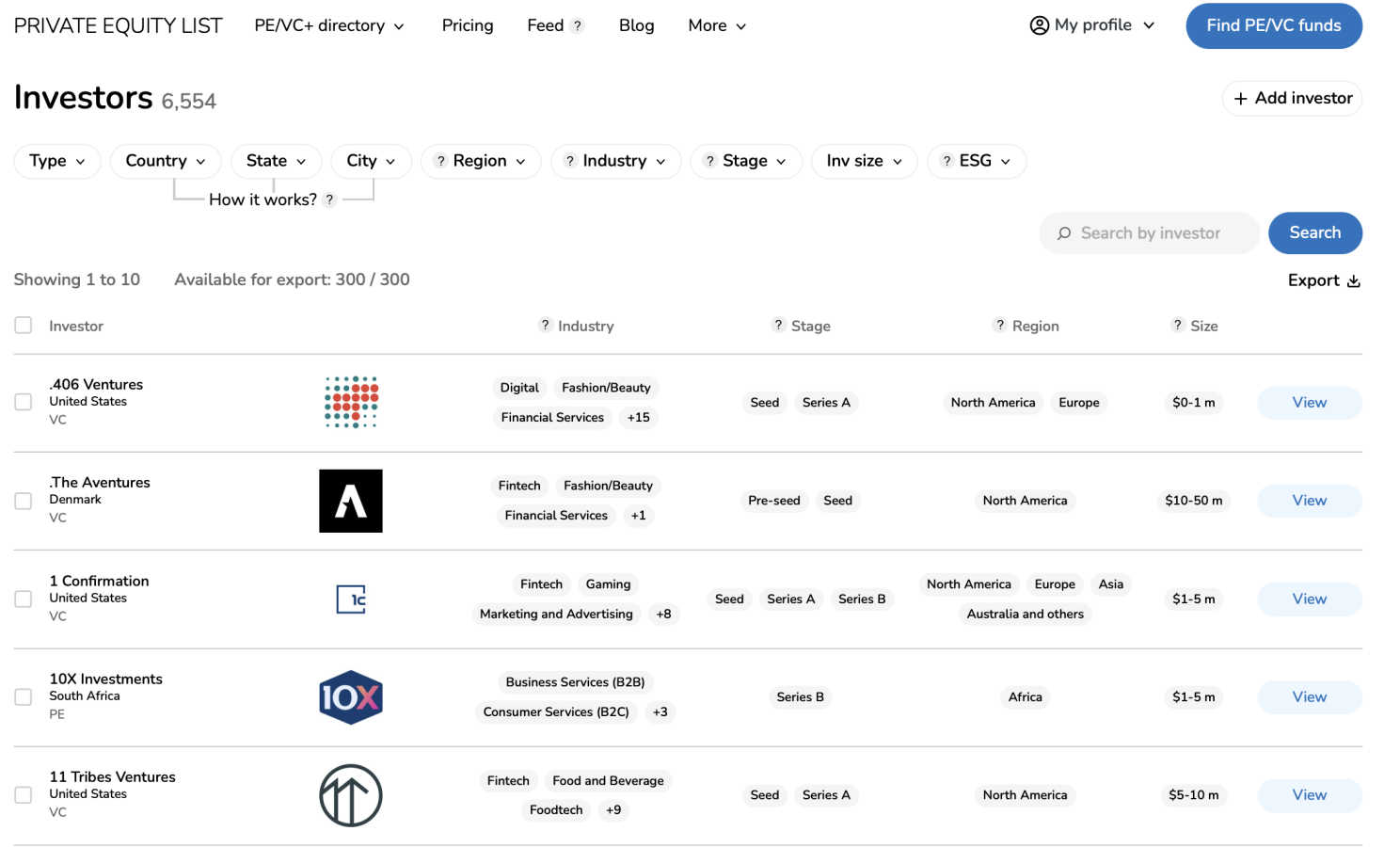

Comprehensive Investor Database

Private Equity List boasts a vast repository of over 7,045 private equity and venture capital investors and 27,160 contacts from various investment teams globally. This extensive coverage ensures that users have access to a wide range of funding options across diverse geographies and sectors, making it easier to find the right fit for their projects.

Super Intuitive User Interface

Designed with user experience in mind, the platform features a lightweight and seamless interface that simplifies the process of finding and connecting with potential investors. Users can easily filter through various options to discover the most suitable investors for their specific needs and projects.

Tailored Investor Shortlists

The platform enables users to create customized investor shortlists, allowing them to focus on the most relevant funding opportunities. This feature is particularly beneficial for consultants and advisors who need to present tailored lists to their clients for fundraising and M&A mandates.

Use Cases of Private Equity List

Fundraising for Startups

Startups can leverage Private Equity List to expedite their fundraising efforts by filtering through potential investors based on criteria such as investment stage, geographical preference, and thesis alignment. This targeted approach significantly increases the chances of securing funding.

Strategic Partner Identification

Consultants and advisors can utilize the platform to craft tailored investor shortlists, enabling them to close clients' fundraising and M&A mandates more efficiently. By having access to curated data, they can offer actionable insights that drive successful outcomes.

Co-Investment Opportunities

Venture capital funds and accelerators can benefit from the extensive database to find co-investors and strategic partners. This functionality enhances their ability to strengthen their portfolio companies’ funding rounds, leading to better investment outcomes.

Research and Reporting

Academics, journalists, and researchers can harness the intelligence provided by Private Equity List for various projects, including market analysis and trend reporting. The platform's comprehensive data supports a wide array of research initiatives, making it a valuable resource for insightful reporting.

Frequently Asked Questions

What is Private Equity List?

Private Equity List is a database that aggregates information on private equity firms and venture capital funds, offering users a powerful search tool to find investors tailored to their specific needs.

How does the AI search function work?

The AI search function utilizes advanced algorithms to deliver tailored results based on user queries. While it provides highly relevant information, users are advised to verify the accuracy of the data retrieved.

Who can benefit from using Private Equity List?

The platform is designed for a diverse audience, including startups seeking funding, consultants looking to create investor shortlists, VC funds searching for co-investors, and researchers requiring access to private equity intelligence.

Is there a free trial available?

Yes, Private Equity List offers basic functions for free, allowing users to explore the platform without the need for a credit card. This provides an excellent opportunity to assess its capabilities before committing to a paid plan.

You may also like:

Fieldtics

Fieldtics is an all-in-one platform for service businesses, streamlining scheduling, customer management, invoicing, and getting paid.

Moon Banking

The largest global bank dataset with AI-native integrations (MCP, OpenClaw, API). For analysts, marketers, developers, institutions.

Tailride

AI-powered invoice and receipt automation from email and web portals